Everything You Need to Know About Payroll Component

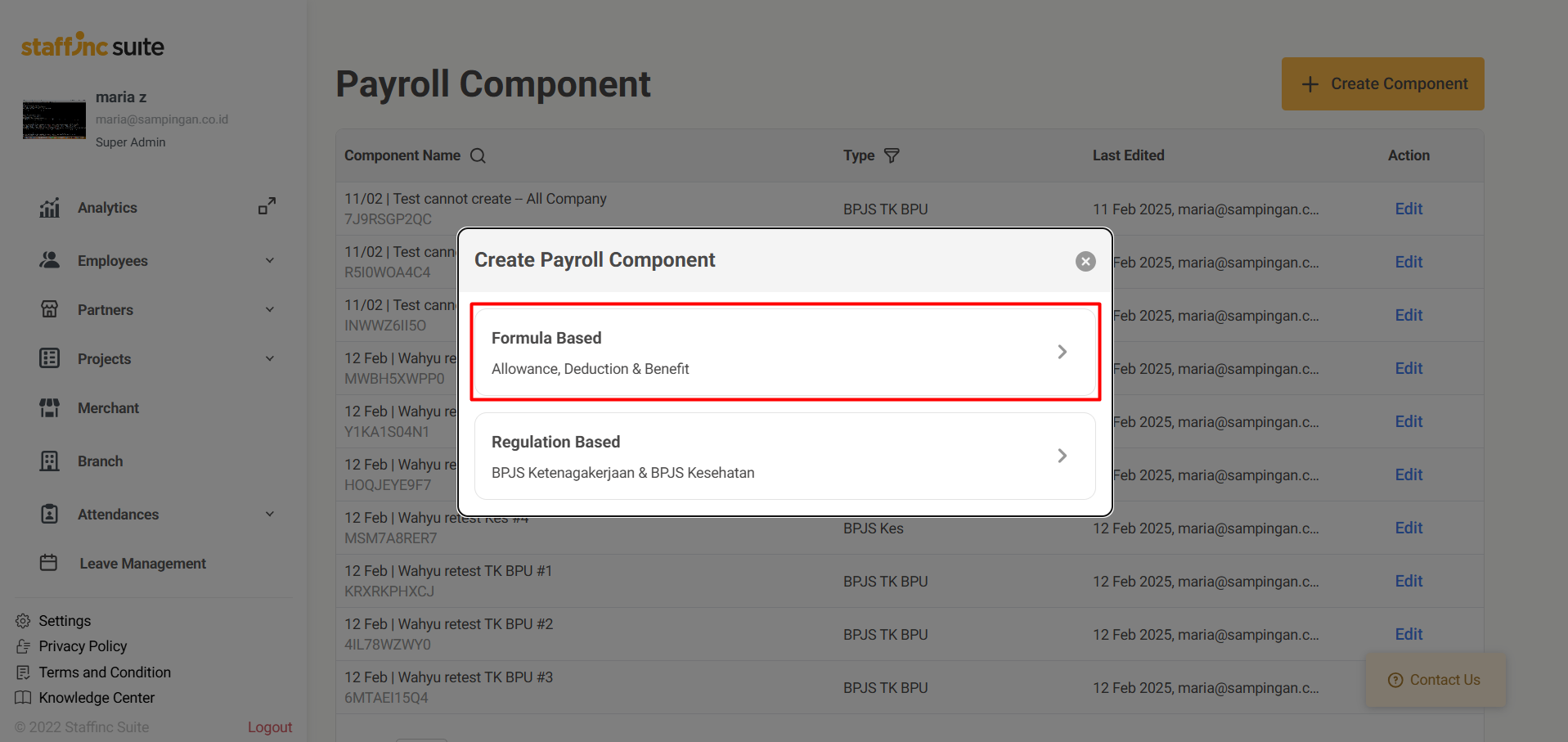

Payroll components are essential elements in salary processing. In Staffinc Suite, there are two types of payroll components:

- Formula-Based – Used for allowances, deductions, and benefits that follow custom calculation formulas.

- Regulation-Based – Used for mandatory government contributions such as BPJS Ketenagakerjaan & BPJS Kesehatan.

When creating a payroll component, it is important to determine the type based on the payroll structure in your organization.

Types of Payroll Components

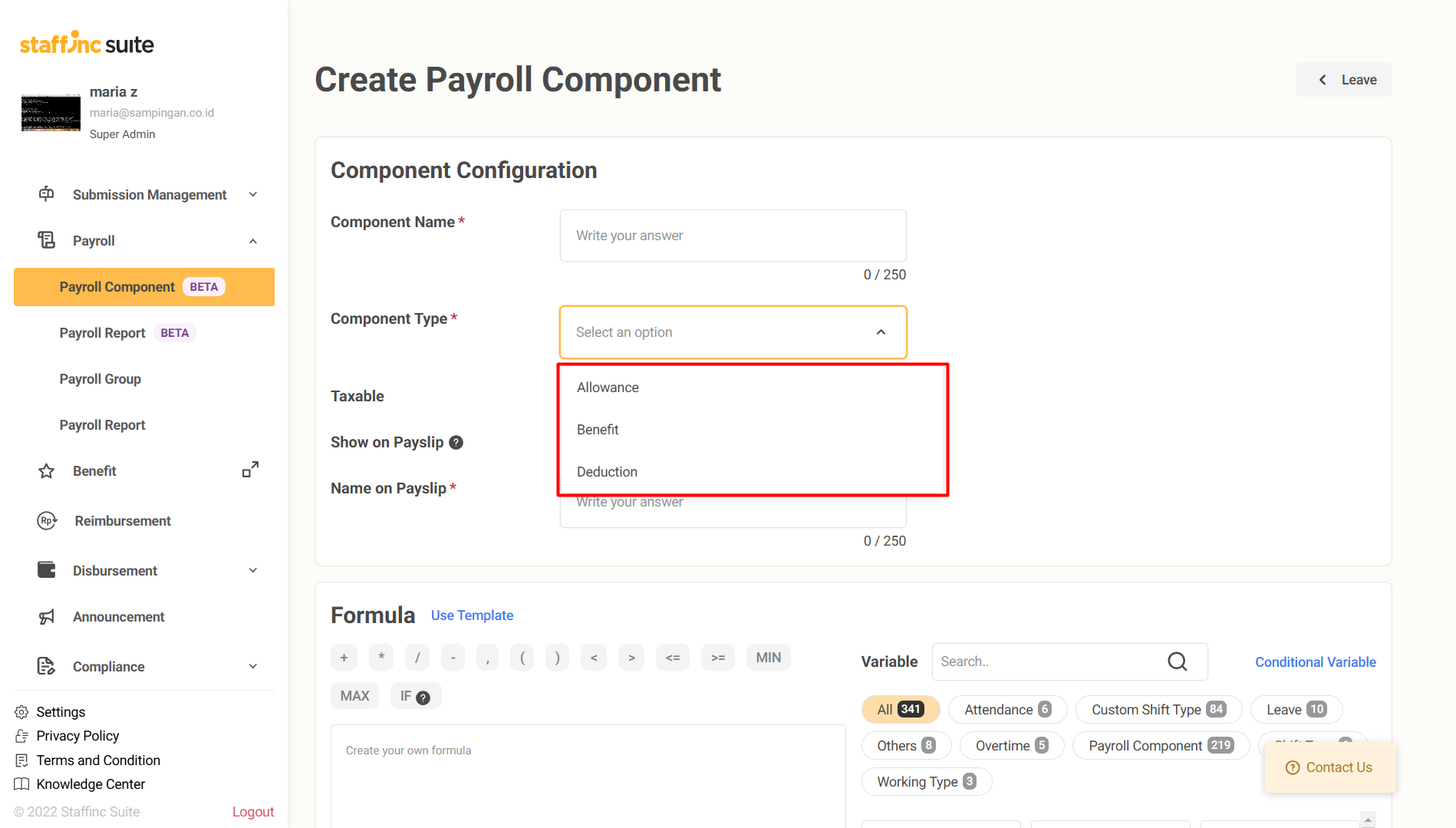

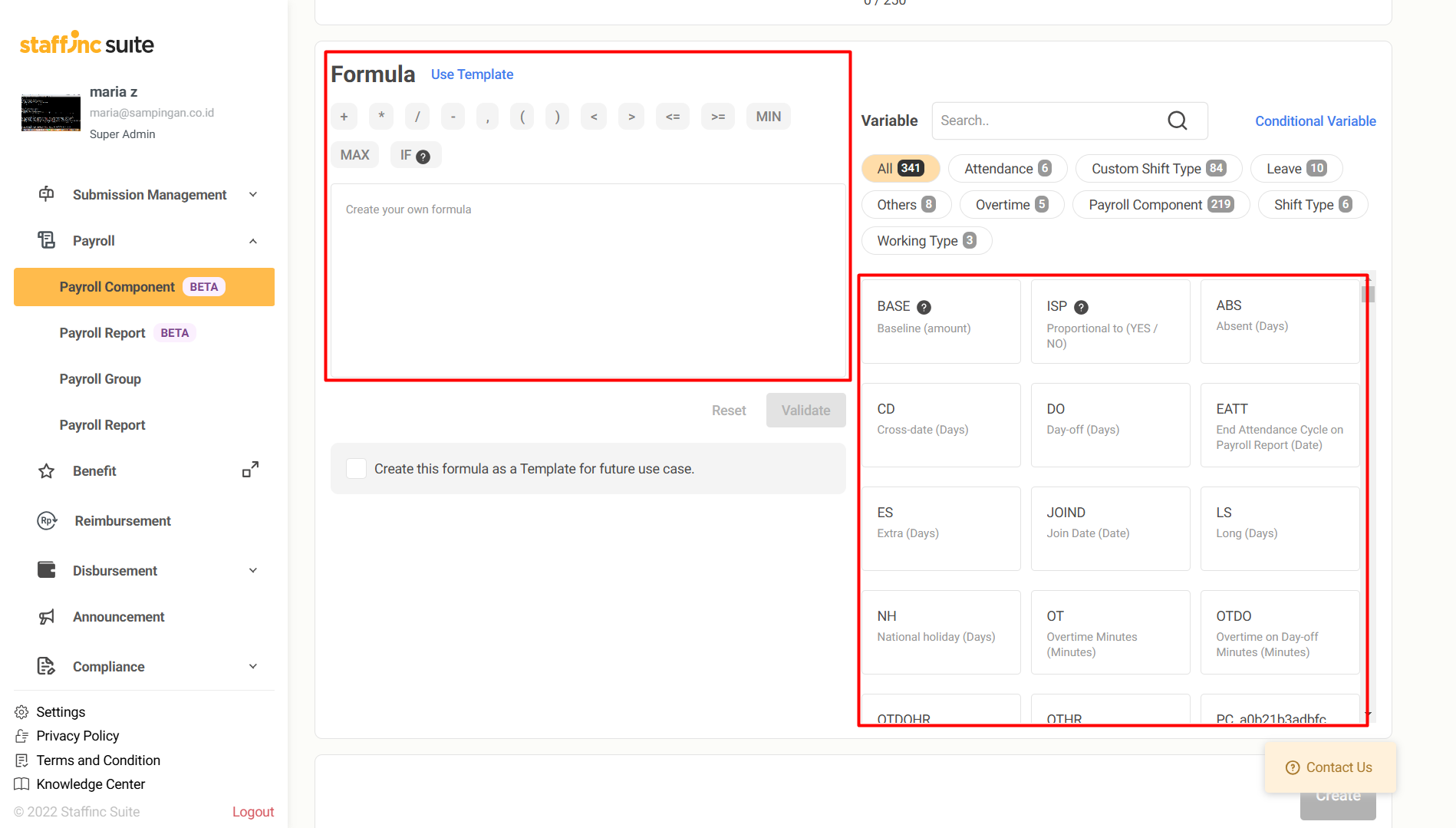

Formula-Based Component

These components are used to define salary elements such as:

- Allowances (e.g., meal allowances, transport allowances).

- Deductions (e.g., loan deductions, penalties).

- Benefits (e.g., performance bonuses).

Formula-Based components provide flexibility, allowing organizations to set up custom formulas using predefined variables and mathematical operations.

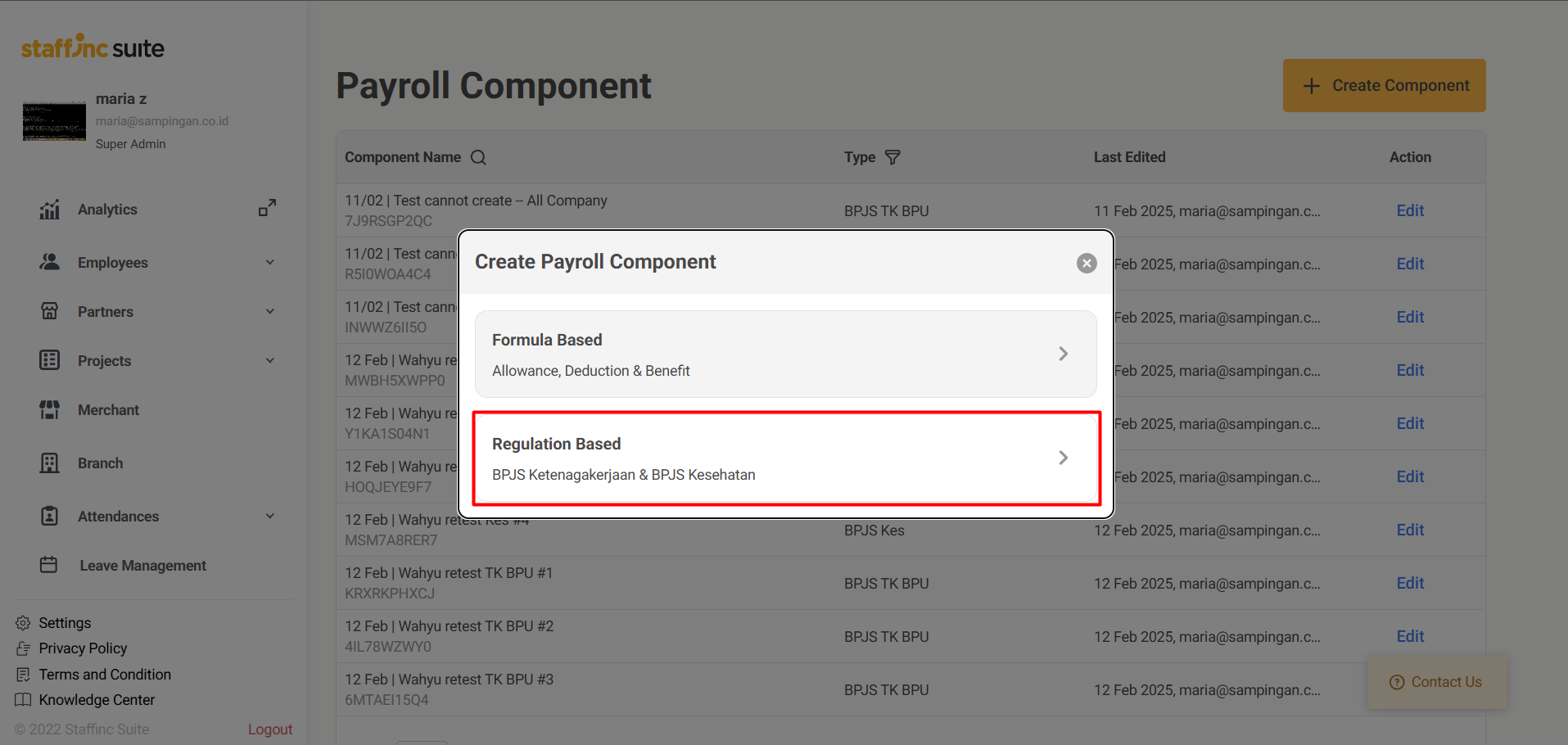

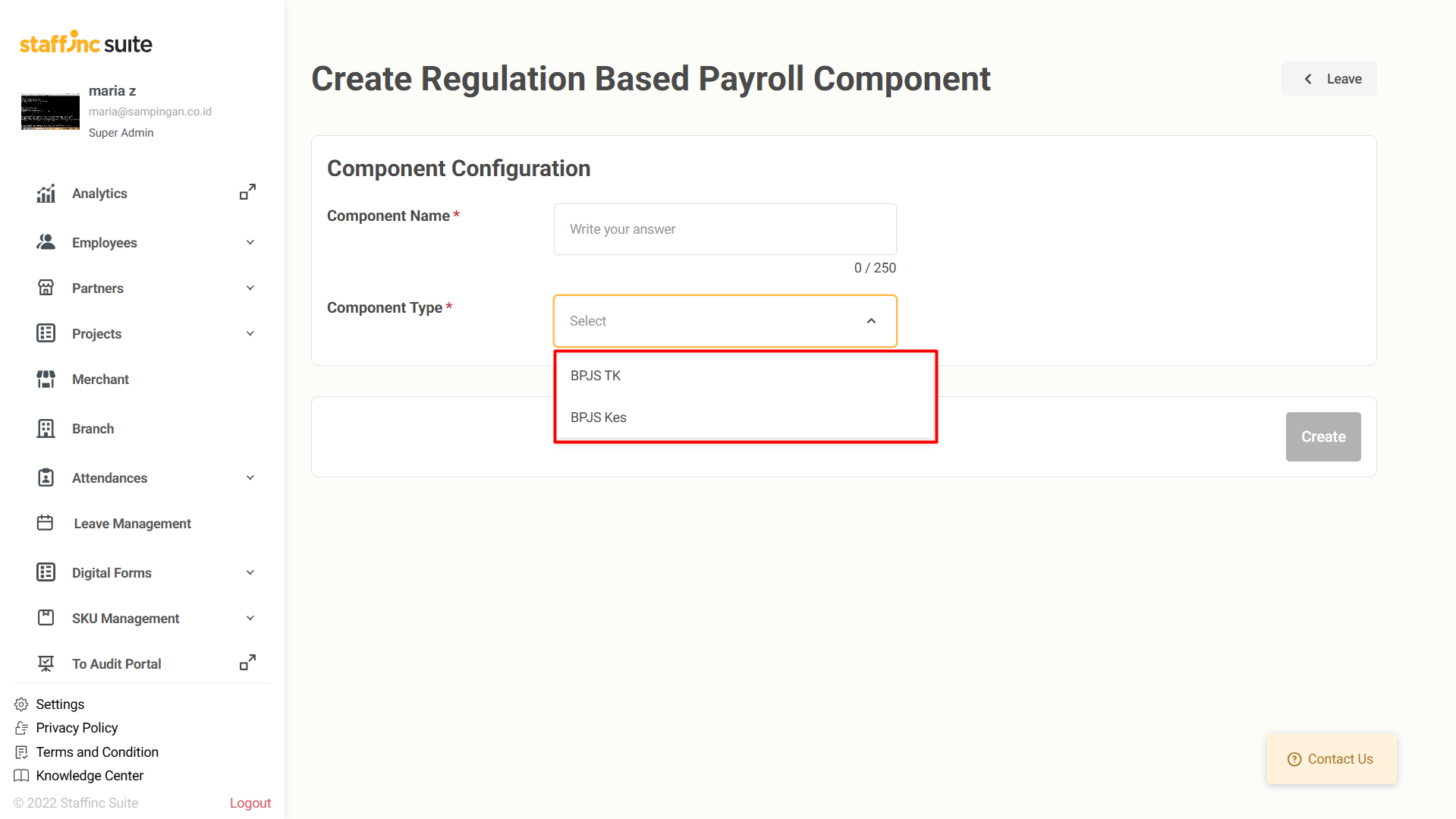

Regulation-Based Components

These components handle payroll elements required by law, such as:

- BPJS Ketenagakerjaan.

- BPJS Kesehatan.

Regulation-Based components ensure compliance with government policies by automatically calculating contributions based on official regulations.

Choosing the Right Payroll Component

When setting up payroll, selecting the correct component type is crucial to ensure accurate salary calculations and compliance with regulations.

- Use Formula-Based components for company-specific allowances, deductions, or bonuses.

- Use Regulation-Based components to manage legally required contributions like BPJS.

With Staffinc Suite, payroll components are structured to ensure seamless and accurate payroll management. 🚀